Bto Hdb Loan

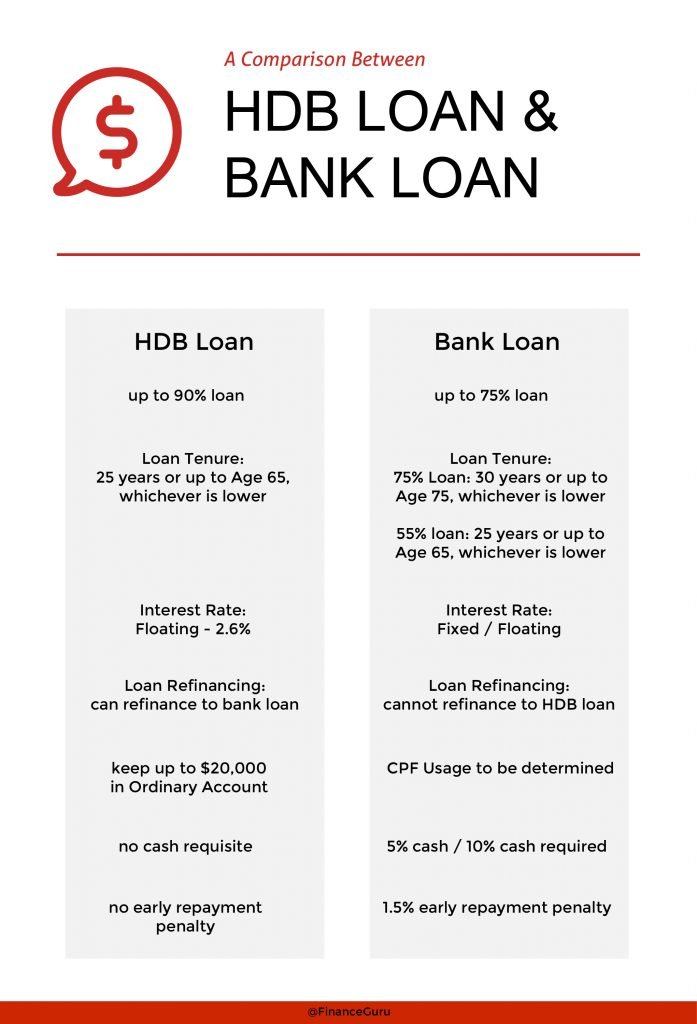

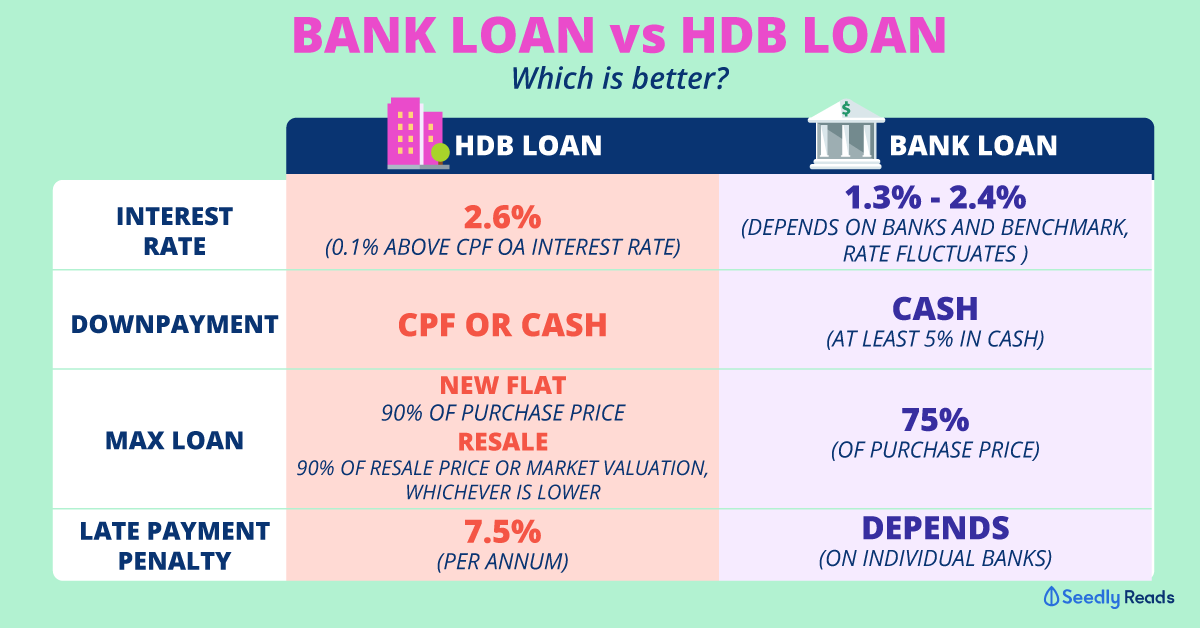

However there is also the staggered downpayment scheme which might help ease the payment burden if you so decide to select bank financing which entails a higher downpayment of 25. Buying a HDB flat can mean a lot both emotionally and financially.

Hdb Loan Vs Bank Loan Which One Should You Pick Money News Asiaone

BTO home loans tend to have slightly higher interest rates as compared to resale packages.

Bto hdb loan. When buying a HDB BTO or resale flat you have a choice between borrowing from a bank or HDB. Flat owners with outstanding HDB loans must buy and renew the HDB fire insurance. Singles can get HDB grants of up to 115000 when applying for.

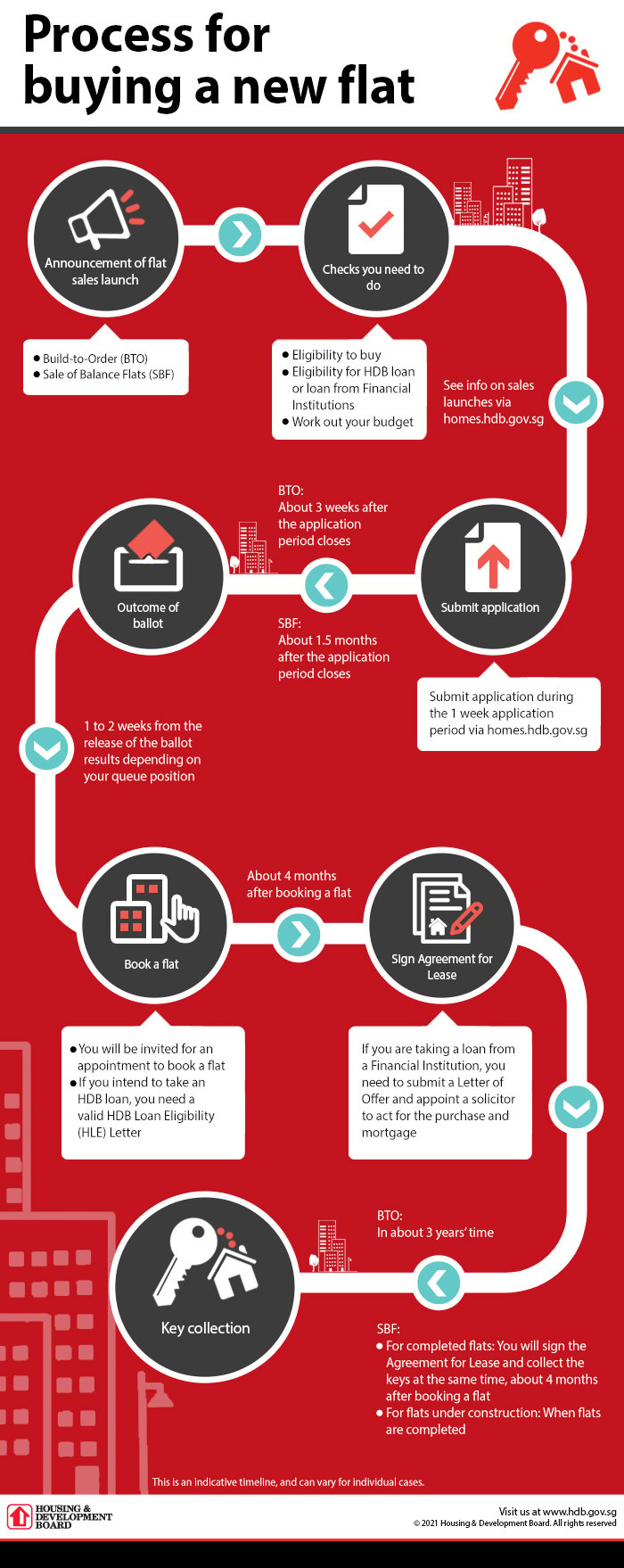

The following guide is based on the assumption that youre eligible for HDB BTO andor have made an application. A higher proportion of flat supply is set aside during each BTO launch for first-timers. You can use your CPF to repay a bank loan for your HDB flat.

This can vary depending on whether you are also eligible for the other priority schemes. Balance of the purchase price. It is also subject to the loan-to-value limit of the flat you intend to buy.

For ease of understanding scroll for a summarised guide on applying for your BTO followed by a case study on approximately how much. Yes both BTO and resale flats have grants from HDB. Most first-time BTO applicants will tend to select the HDB loan route due to limited capital resources at that stage to fork out the higher downpayment of 25 through a bank loan.

Most people will want to get an HDB loan however first-time homeowners are usually unfamiliar with the process of obtaining it and the HDB Loan Eligibility HLE letter. Housing Loan from HDB. Thats because it marks a key milestone for every Singaporean adult.

The eligibility criteria is the same as that for buying a new HDB flat. How Much HDB Grant Can a Single Get. This article will break down for you what the HLE letter is and how to go.

This loan is given to you by the Housing and Development Board. From Sep 2021 onwards eligible applicants will get the Enhanced CPF Housing Grant EHG depending on their income status. To see if you can get a housing loan from HDB and the amount you can get based on your financial situation you need to.

Five-year premiums including 7 GST range from S271 for 2-room flats to S810 for Executive flats Mortgage Repayments. The purpose of this video is only for education and entertainment purposes only. If taking bank loan with 75 per cent LTV.

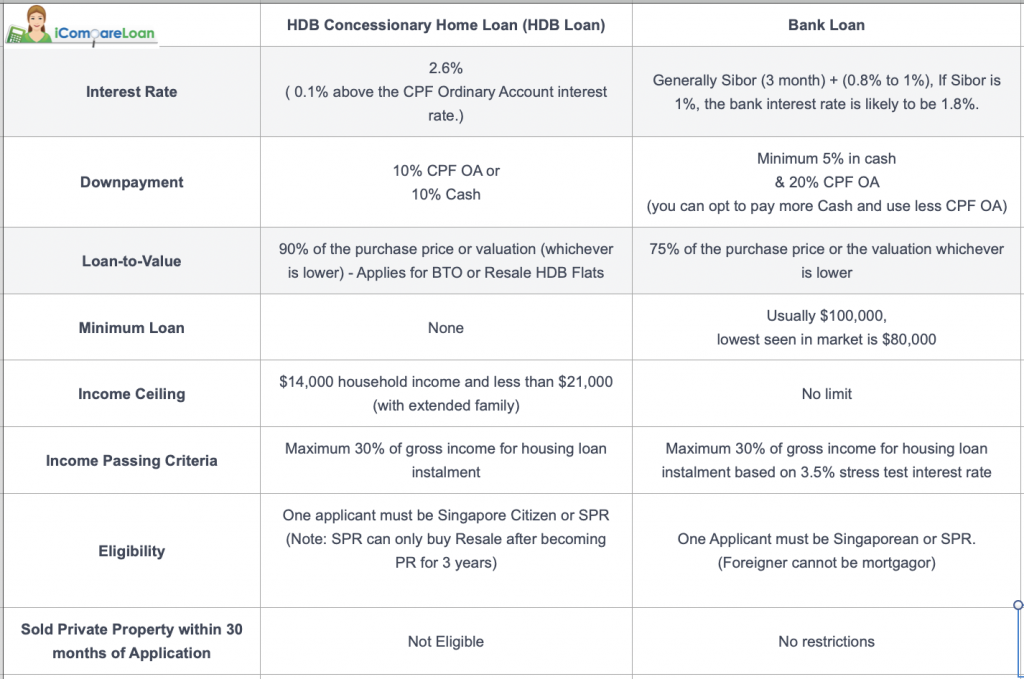

The maximum housing loan amount is determined based on your age income and financial situation. HDB loan at a glance. Bank loan Rates for resale HDB BTO flats Nov 2021 HDB loan interest rates from banks differ for a new Build-To-Order BTO and a new completed resale home.

We are also assuming that youll be taking a HDB loan considering the extreme difficulty for an unemployed couple to get a bank loan. Your eligibility for an HDB concessionary loan. You cannot apply for a 4-room BTO flat however.

Five per cent of purchase price with CPF andor cash. The loan that you take is a decision that can make or break your finances. Have at least one Singapore citizen applicant.

An HDB loan is only applicable only if youre buying a HDB flat. While not a priority scheme first-time BTO applicants also known as first-timers in HDB lingo do enjoy privileges. What Is The HDB Loan About.

Able to loan up to 90 of the cost at 270000. 960 Rochor BTO flats launched under prime location model. We provide housing loan to eligible flat buyers.

I am not a financial professional. If youre applying for a new HDB flat or buying one from the resale market you can either pay for it in full take a bank loan or get the HDB concessionary loan. If youre taking HDB loan from 162 to 810 for five years.

What is an HDB loan. Qualify for a new flat under one of HDBs eligibility schemes. HDB to claw back 6 of resale price The highly anticipated PLH project - River Peaks I and II in Rochor - comes with stricter buying and.

This loan wont be applicable if you plan to purchase a private residence. The housing loan amount is subject to our credit assessment and the prevailing eligibility conditions. I am a random guy on youtube.

Housing Loan from HDB We offer housing loan to eligible flat buyers. You dont have to wipe out your CPF Ordinary Account The interest rate of HDB loan is 01 above the CPF Ordinary Accounts interest rate as of now the interest rate of HDB loan is at 26. First-timers also receive an additional ballot chance for a total of 2 ballot chances compared to.

Be at least 21 years old. CPF Ordinary Accounts interest rate is fixed at 25 for the longest time Note. The important point to note is that interest rates for a new HDB home loan provided by banks are usually lower historically between 130 to 2.

The key thing to note is that the HDB loan has an income ceiling of 14000 21000 for extended families. As you can see the lower your household income the more EHG grants you will receive.

Everything You Need To Know About The Hdb Bto Payment Timeline

Here S Why It Makes Sense To Take The Maximum Hdb Home Loan You Can When Buying Your First Flat

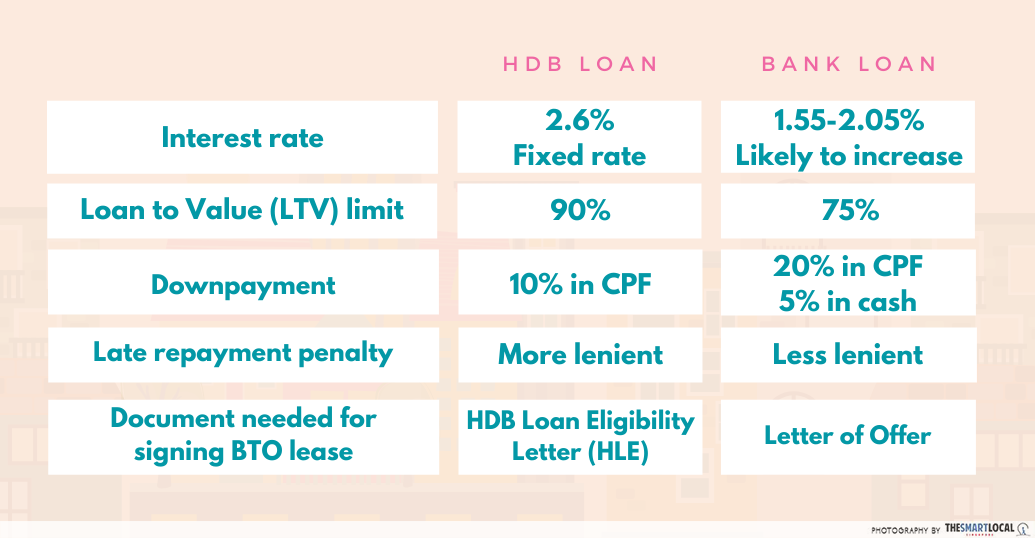

Hdb Loan Vs Bank Loan The Ultimate Financing Comparison

The Bto Guide To End All Bto Guides 2019 Part 2 Understanding Prices Financing

Ultimate Guide Buying A Bto For Couples The Big 3

Hdb Loan Vs Bank Loan Why I Took An Hdb Loan With A Slight Tinge Of Regret New Academy Of Finance

Hdb Hdb Loan Eligibility Application

Step By Step The Ultimate Bto Crash Course How To Adult

Hdb Loan Or Bank Loan How To Choose One

Hdb Loan Vs Bank Loan Which Should You Choose Financeguru

A Homeowner S Ultimate Guide Hdb Loan Vs Bank Loan Which Is Better

How To Apply For Bto In Singapore Balloting Loans Unit Selection

Hdb Loan Vs Bank Loan Which Is Better For You Mortgage Master Blog

Hdb Loan Calculator Vs Bank Loan

Should You Use Cash Or Cpf To Pay For Your Home

Can I Buy Resale Hdb If I Own Private Property Property Walls

Hdb Loan Vs Bank Loan Which Is The Best Geraint Liu Educating Enlightening Empowering You To Achieve Financial Freedom

How Much Must I Earn To Afford A Hdb Flat In Singapore October 2019